Introduction to POS 11 in Medical Billing

If you work in healthcare administration, you’ve probably heard the term pos 11 in medical billing more times than you can count. Yet despite its frequent use, many professionals still struggle to fully understand its financial and compliance impact.

In simple terms, pos 11 in medical billing refers to services provided in a physician’s office setting. However, its role goes far beyond just identifying location. It directly influences reimbursement, payer policies, audit exposure, and overall revenue cycle performance.

Healthcare reimbursement is becoming more complex every year. Therefore, understanding pos 11 in medical billing is no longer optional — it’s essential. Whether you’re a physician, medical coder, biller, or practice manager, mastering this code can protect your revenue and ensure regulatory compliance.

Let’s break it down step by step.

What Does POS 11 Mean?

Definition of Place of Service Codes

Place of Service (POS) codes are two-digit numeric codes used on healthcare claims to specify where services were provided. These codes are required on CMS-1500 claim forms and electronic equivalents.

Specifically, pos 11 in medical billing designates:

Office – Location where the health professional routinely provides health examinations, diagnosis, and treatment.

The Centers for Medicare & Medicaid Services (CMS) defines and maintains these codes. You can review official guidelines directly from CMS here:

https://www.cms.gov

Why POS Codes Matter in Healthcare Claims

POS codes determine:

-

Reimbursement rate

-

Facility vs non-facility payment

-

Audit risk

-

Claim approval or denial

When pos 11 in medical billing is used correctly, providers typically receive the non-facility payment rate, which is often higher than facility-based payments. That difference can significantly impact revenue over time.

Why POS 11 in Medical Billing Is Critically Important

Reimbursement Impact

The biggest reason pos 11 in medical billing matters is reimbursement. Medicare and commercial insurers differentiate between:

-

Facility settings (hospital outpatient)

-

Non-facility settings (physician office)

Because overhead costs are assumed to be covered by the physician practice in an office setting, the reimbursement structure reflects that. Therefore, accurate reporting of pos 11 in medical billing ensures proper payment.

Compliance and Audit Risk

Incorrectly reporting pos 11 in medical billing when services were actually performed in a hospital-owned outpatient clinic can trigger:

-

Overpayment recoupments

-

Audits

-

Financial penalties

Auditors frequently review place of service discrepancies. Even minor mistakes repeated across multiple claims can snowball into significant compliance concerns.

How POS 11 in Medical Billing Affects Payment Rates

Medicare Payment Structure

Medicare differentiates payments using:

-

Facility rate

-

Non-facility rate

When pos 11 in medical billing is reported correctly, physicians receive the non-facility rate. This often includes practice expense components reflecting office costs like:

-

Staff salaries

-

Supplies

-

Equipment

-

Rent

Misreporting can result in lower payments or recoupments.

Commercial Insurance Variations

Private payers may have different reimbursement models. Some align with Medicare, while others apply proprietary rules. Nonetheless, Place of Service 11 remains a key determinant in claim processing.

Insurance contracts may even specify payment differentials tied directly to POS reporting accuracy.

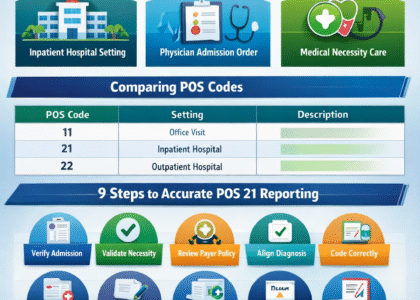

POS 11 vs Other Common POS Codes

Understanding differences helps avoid costly errors.

POS 22 – Outpatient Hospital

POS 22 indicates hospital outpatient services. Payments differ significantly from Place of Service 11often reflecting facility reimbursement models.

POS 19 – Off-Campus Outpatient Hospital

POS 19 applies to off-campus hospital departments. This is where confusion commonly arises. A clinic may look like a physician office but legally operate as a hospital outpatient department.

Incorrectly using Place of Service 11 instead of POS 19 can lead to audit exposure.

Key Differences Table

| POS Code | Description | Payment Type | Risk Level |

|---|---|---|---|

| 11 | Office | Non-facility | Moderate |

| 22 | Outpatient Hospital | Facility | High |

| 19 | Off-Campus Outpatient | Facility | High |

Clarity is crucial. Always verify ownership and enrollment status before submitting claims under Place of Service 11

Documentation Requirements for Place of Service 11

Clinical Documentation

Proper documentation must clearly indicate:

-

Office address

-

Provider credentials

-

Service date

-

Nature of service

If audited, documentation must support that services truly occurred in a physician office to justify place of service code

Billing Documentation

Billing teams should verify:

-

Provider enrollment status

-

Location taxonomy

-

NPI linked to correct site

Consistency between enrollment data and place of service code usage reduces denial risk.

Common Errors When Using POS 11 in Medical Billing

Even experienced billing teams make mistakes.

Coding Mistakes

Common issues include:

-

Default POS selection in EHR

-

Copy-forward errors

-

Misunderstanding clinic ownership

If a hospital acquires a private practice but billing continues under Medical billing POS 11 code, claims may be incorrect.

Revenue Loss Scenarios

Improper use of Medical billing POS 11 code can result in:

-

Claim denials

-

Reduced payments

-

Repayment demands

-

Increased audit scrutiny

Small errors repeated daily can translate into thousands of dollars in lost revenue.

Best Practices for Accurate POS 11 Reporting

Internal Audits

Regular audits should review:

-

POS distribution reports

-

Location enrollment data

-

Payment variance trends

Tracking how often Medical billing POS 11 code appears on claims can reveal inconsistencies.

Staff Training

Education matters. Coders and billers should understand:

-

Facility vs non-facility rules

-

Ownership structures

-

CMS updates

Annual training reduces misuse of POS code 11.

Technology and POS 11 in Medical Billing

EHR Integration

Electronic Health Records often default to a specific POS. If incorrectly configured, POS code 11 may be applied automatically.

Regular system checks prevent systemic errors.

Practice Management Systems

Modern billing software allows location mapping. Accurate configuration ensures POS code 11 aligns with:

-

Rendering provider

-

Billing provider

-

Service location

Automation helps — but oversight remains essential.

Compliance, Regulations, and CMS Guidelines

CMS Requirements

CMS provides official POS code definitions and updates annually. Staying current ensures compliant use of POS code 11.

Failure to align with CMS definitions may expose practices to overpayment determinations.

Fraud and Abuse Considerations

Improperly reporting Place of Service 11 to obtain higher reimbursement may be interpreted as:

-

False claims

-

Misrepresentation

-

Billing fraud

Intent matters, but ignorance isn’t always a defense. Compliance programs must address POS accuracy.

Real-World Examples of POS 11 in Medical Billing

Let’s make this practical.

Example 1: Independent Physician Office

A cardiologist sees a patient in a privately owned clinic. Services are properly billed under Place of Service 11 resulting in non-facility payment. Documentation matches enrollment records.

No issue.

Example 2: Hospital-Acquired Practice

A hospital acquires a family medicine practice. However, billing continues using Place of Service 11 instead of POS 19. After an audit, Medicare recoups overpayments.

Lesson learned: ownership matters.

Example 3: Telehealth Confusion

Some telehealth services historically used office POS with modifiers. Always verify current payer policy before using pos 11 in medical billing for remote services.

FAQs About POS 11 in Medical Billing

1. What is POS 11 in medical billing used for?

POS 11 identifies services performed in a physician’s office setting. It signals non-facility reimbursement eligibility.

2. Does POS 11 pay more than hospital outpatient?

Often yes. pos 11 in medical billing typically qualifies for non-facility rates, which can be higher than facility rates.

3. Can a hospital-owned clinic use POS 11?

Usually no. Hospital-owned clinics often require POS 19 or 22. Misusing pos 11 in medical billing may trigger audits.

4. How does POS 11 affect Medicare claims?

Medicare calculates payment based on facility versus non-facility designation. place of service codegenerally results in non-facility reimbursement.

5. Is POS 11 required on all CMS-1500 forms?

Yes. A place of service code, including place of service code when applicable, must be reported on professional claims.

6. How can practices prevent POS errors?

Regular audits, staff training, EHR configuration review, and compliance oversight help ensure correct use of pos 11 in medical billing.

Conclusion

Understanding place of service code is more than memorizing a code. It’s about protecting revenue, maintaining compliance, and strengthening operational accuracy.

When used correctly, pos 11 in medical billing ensures proper non-facility reimbursement and reduces audit exposure. However, misuse can lead to denials, repayment demands, and compliance risk.

Healthcare regulations evolve constantly. Therefore, practices should:

-

Monitor CMS updates

-

Conduct internal audits

-

Train billing staff annually

-

Review ownership structures regularly

In today’s complex reimbursement landscape, mastering Place of Service 11 isn’t just helpful — it’s powerful.

By applying the best practices outlined in this guide, your organization can maximize reimbursement, maintain compliance, and build a stronger, more resilient revenue cycle.